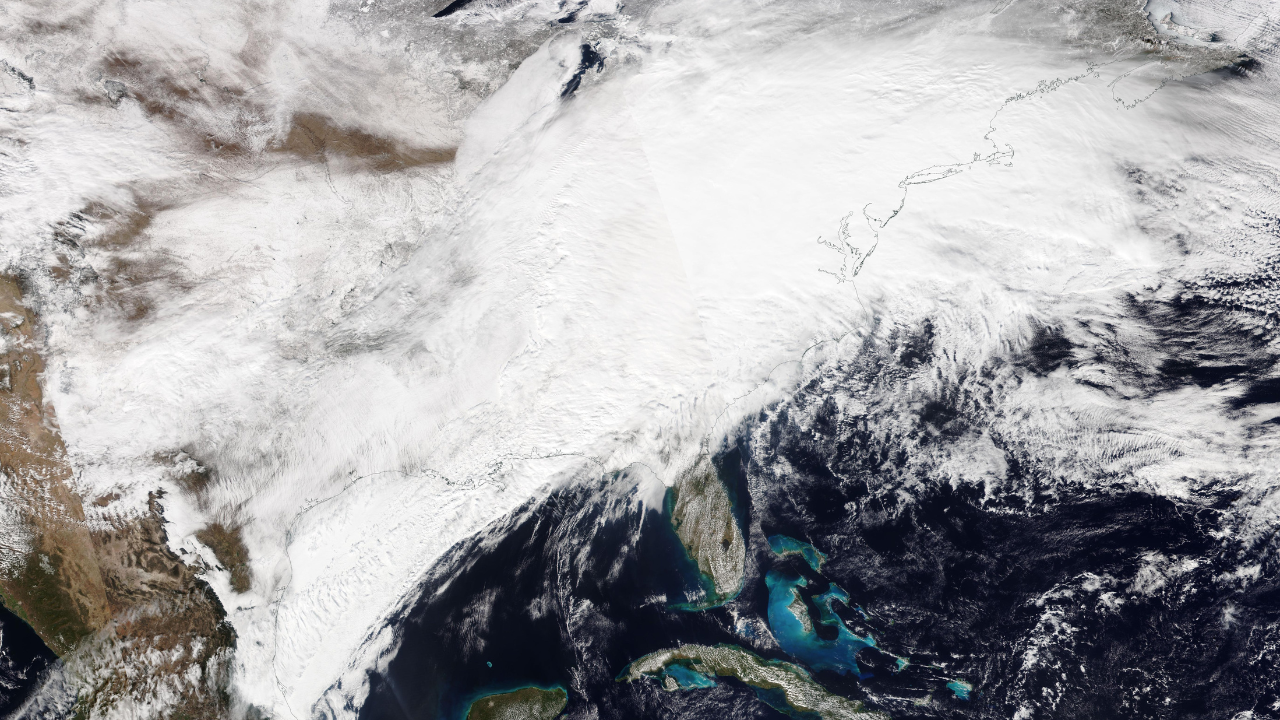

As Winter Storm Fern descended on Texas over the weekend, temperatures plummeted to dangerous lows unseen in years. The Dallas-Fort Worth area faced wind chills as low as minus 12 degrees Fahrenheit, with forecasts calling for single-digit highs across the state through Tuesday.

The extreme cold triggers a predictable crisis: as heaters flick on across millions of homes and businesses, electricity demand surges toward the limits of available supply. Grid operators watched the forecasts with growing alarm, knowing that even minor disruptions could cascade into widespread blackouts. But what officials feared most wasn’t whether the system had the reserves to withstand it; it was whether the system had the reserves to withstand it.

The Demand Spike Nobody Wanted

Electricity demand across Texas surged dramatically as the Arctic blast intensified, with significant power consumers ramping up their consumption. ERCOT, the grid operator serving most of Texas and nearly 26 million people, began monitoring reserve margins under intense scrutiny as usage approached critical thresholds.

Historical data show that for every one-degree drop in temperature, demand rises by roughly 50 megawatts, a multiplier effect that compounds as the cold deepens. By Sunday morning, forecasters projected demand could reach levels last seen during the 2021 grid crisis, when a similar winter event killed hundreds and caused over $130 billion in damages. The parallel was inescapable, and so was the question: Would Texas learn from that catastrophe?

Lessons Unlearned, Systems Untested

Texas deregulated its power market in the late 1990s, a decision that prioritized low costs over resilience and left the grid vulnerable to extreme weather. Unlike most of the country, ERCOT operates as an independent system with minimal federal oversight, a structure praised for efficiency but criticized for underfunding winterization and backup capacity.

The 2021 crisis exposed fatal gaps: power plants froze, natural gas pipelines iced over, and Texans died in the cold. State officials promised reforms. Yet five years later, the grid still lacked the redundancy experts said it needed. Industry observers noted that while some improvements had been made, they were piecemeal and insufficient. The stage was set for another test that the grid’s architects hoped would be passed but couldn’t guarantee.

The Backup Generation Puzzle

Hidden across the United States are roughly 35 gigawatts of backup generators, mostly idle capacity, owned by data centers, hospitals, manufacturing plants, and other major industrial users. These machines, designed to keep operations running during local outages, represent a significant reserve of power that could stabilize the grid during emergencies if activated.

Yet federal law did not clearly authorize grid operators to compel their use during crises, leaving this vast resource untapped. Regulators and grid operators knew of this paradox for years but lacked apparent legal authority to act. As Winter Storm Fern approached and demand forecasts turned dire, officials in Washington began asking a simple but previously taboo question: What if we could unlock that power?

The Emergency Order

On Saturday, January 25, 2026, U.S. Energy Secretary Chris Wright signed an emergency order under Section 202(c) of the Federal Power Act, a rarely invoked authority allowing the government to mandate extraordinary measures to prevent grid collapse. The order authorized ERCOT to direct large power users, principally data centers and industrial facilities, to switch from grid power to onsite backup generators, freeing up electricity for residential and essential services.

The order was stunning in its scope and its assertion of federal control over Texas’s fiercely independent grid operator. It signaled that the Biden-to-Trump transition had not softened federal resolve on grid security. “The Trump administration is committed to unleashing all available power generation needed to keep Americans safe during Winter Storm Fern,” Wright declared. The order remained in effect through Tuesday.

83,000 in the Dark

Even as federal authorities mobilized, the storm’s front edge was already knocking customers offline. By Sunday afternoon, outage trackers showed more than 83,000 Texans without power, a number that climbed throughout the day and into the evening. Most outages clustered in East Texas, where the storm hit hardest and where aging infrastructure proved least resilient to ice and wind.

Utility crews, hampered by treacherous road conditions and freezing temperatures, struggled to reach damaged lines and downed poles. Unlike the 2021 catastrophe, which saw millions lose power for days, these outages remained localized, painful for those affected, but not yet systemic. Still, the psychological impact reverberated: Texans who remembered 2021 watched power companies dispatch crews and prayed the cascading failures would not begin.

Families in Freezing Homes

Behind the outage statistics lay human suffering measured in real time. Residents huddled in blankets, running cars in garages (a dangerous practice that can cause carbon monoxide poisoning), and sheltering with neighbors who had power. Hospitals and dialysis centers, exempted from the backup-generator order, continued treating critically ill patients while managing grid stress. Nursing homes and assisted-living facilities, filled with elderly residents vulnerable to cold, implemented emergency protocols, including evacuation routes to warmer facilities.

One dialysis provider in Houston reported treating patients from rural areas who had driven hours in brutal conditions to reach clinics with power. A mother in Dallas shared photos on social media of children bundled indoors wearing winter coats and hats, their breath visible in the frigid air. The cold was not hypothetical; it was a daily battle for survival.

Tech Giants Become Grid Operators

The emergency order placed data centers’ massive facilities operated by Amazon, Google, Microsoft, Meta, and other tech corporations at the center of the grid crisis. These installations consume as much electricity as small cities, their racks of servers running 24/7 to power cloud services, artificial intelligence, and digital infrastructure. Under the Section 202(c) order, ERCOT could compel them to fire up backup generators, transferring their power load to diesel and natural gas.

The move was pragmatic but symbolically significant: the companies that had built Texas’s data-center boom, attracted by cheap power and minimal regulation, were now conscripted to defend the grid they had strained. Tech companies, generally supportive of grid stability, complied without public resistance. Yet the precedent of the federal government directing private infrastructure in the name of emergency raised questions about future sovereignty over Texas’s energy future.

A Nationwide Pattern Emerging

Winter Storm Fern was not isolated. Across the nation, climate change and extreme-weather cycles were intensifying stress on aging power grids from California to New York. Utilities reported record peak-demand events in summer heat waves and winter cold snaps with increasing frequency. Grid operators in other states, such as California’s CAISO and PJM Interconnection in the Mid-Atlantic, were lobbying for similar federal authorities to unlock backup generation during emergencies.

The Texas crisis became a test case. If the Section 202(c) order succeeded in preventing blackouts, other grid operators would cite it as precedent for their own requests. Energy policy experts saw the Texas emergency as a watershed moment: the beginning of a shift toward federal intervention in electricity markets previously governed by regional independence.

The Data Center Paradox Revealed

The emergency order exposed a more profound truth about modern power grids: the infrastructure built to support the digital economy had become so energy-intensive that it was now essential to grid stability. Data centers in Texas consumed roughly 20–25% of all electricity generated by ERCOT, a share that had nearly doubled in the past five years.

The irony was stark: the cloud services and AI systems that society had come to depend on were now bottlenecks in the grid’s ability to meet basic human needs, such as heating. If data centers hadn’t existed, demand might have been manageable. But they did exist, and unplugging them temporarily was politically and economically fraught yet necessary. The crisis thus crystallized a long-simmering question about energy priorities: Should the grid prioritize digital services or human survival during extreme weather?

ERCOT’s Credibility Hanging

ERCOT’s leadership faced intense scrutiny as the emergency unfolded. The organization had spent five years and billions on promised grid improvements since 2021, yet a similar winter event was still triggering federal emergency powers. Retailers, manufacturers, and municipal leaders expressed frustration that the grid operator had not done more to winterize, add renewable baseload capacity, or incentivize demand reduction.

One industrial manufacturer told reporters, “We were told the grid was fixed. This doesn’t look fixed.” ERCOT defended itself by noting that the emergency order was precautionary and that localized outages did not constitute grid failure. But the messaging felt defensive. The organization’s credibility rested on its ability to manage future winters without repeated federal rescues.

The Federal Takeover Question

The emergency order raised a thorny political question: Should ERCOT remain independent, or should Texas yield more authority to federal regulators? Conservative officials argued that federal overreach was dangerous and that Texas should be trusted to manage its own grid. Progressive voices countered that deregulation had failed and that federal standards were necessary.

Energy Secretary Wright’s invocation of Section 202(c) was a statement that the federal government would act unilaterally if state and regional systems faltered. Some Texans saw it as appropriate; others viewed it as a harbinger of regulatory changes that could increase electricity prices or restrict Texas’s energy independence. The debate was not new, but the emergency had made it urgent.

Winter Wednesday and Beyond

By Tuesday evening, as Winter Storm Fern’s coldest hours passed and temperatures began a slow climb back above freezing, ERCOT reported that the grid had remained stable. No emergency level 3 was declared; no rolling blackouts occurred statewide. The backup generators at data centers had not been fully activated, a sign that the emergency order alone may have been enough to deter demand surges.

Utility crews worked around the clock to restore power to the 83,000 customers still without it. The outages were expected to be fully cleared by Wednesday afternoon. On the surface, the story looked like a success: the system held. But officials knew it was narrower than they were comfortable with.

Skepticism Amid Relief

Energy analysts warned against overconfidence. The storm had been severe but not catastrophic; temperatures had not stayed at minus 12 for a whole week. If Fern had stalled over Texas or if another system had followed in rapid succession, the grid might have fractured despite federal intervention. One energy policy expert noted, “We got lucky.

The emergency order worked because we didn’t need it to work hard.” Grid upgrades since 2021 had added capacity, but wind generation had underperformed during the extreme cold, a known vulnerability that remained largely unaddressed. Winterization of natural gas infrastructure was incomplete. Renewable energy’s role in winter reliability remained uncertain. The temporary victory over Winter Storm Fern could lull policymakers into believing the grid crisis was resolved, when in reality the system remained fragile.

The Next Crisis

As Texans thawed from Winter Storm Fern and life returned to routine, a question loomed: How many more winters would the grid face before a permanent solution emerged? The 35 gigawatts of backup generation had proven its value as an emergency pressure valve, but it was not a strategy. Real solutions, whether building new natural gas capacity, expanding renewables with storage, federalizing the grid, or simply accepting higher energy prices, remained contentious and unresolved.

Energy Secretary Wright pledged that the administration would continue to prepare for future crises. But preparation meant investment, and investment meant cost. Would Texas, a state that had long defined itself by cheap, abundant energy, accept the price of resilience? The answer would shape not just Texas’s grid but the energy landscape of a warming America struggling to balance supply, demand, and survival.

Sources

Bloomberg – “US Declares Power Emergency in Texas as Storm Boosts Demand”

Fox 4 News – “Texas winter storm: Energy emergency declared to keep ERCOT grid stable”

Texas Tribune – “Live winter storm updates: Texas power grid remains stable”

U.S. Department of Energy – “Energy Secretary Issues Emergency Order to Secure Texas Grid Amid Winter Storm Fern”

U.S. Department of Energy – “Energy Secretary Prepares to Unleash Backup Generation Ahead Winter Storm Fern”

Click2Houston (KPRC 2) – “U.S. Department of Energy issues emergency order for backup resources”