Even with all the designer trends and flashy cars, most wealthy people live a very quiet life. A millennial shows up to brunch in a leased BMW with a $4,000 Louis Vuitton bag and a $15 green juice. Meanwhile, Warren Buffett drives his hail-dented 2014 Cadillac to McDonald’s.

Research from HEC Paris and Princeton University shows 75% of luxury spending comes from middle and working-class consumers, not the ultra-wealthy. The lesson? True wealth isn’t flashy—it’s the freedom to stop performing it.

Let’s look at what separates real wealth from the illusion.

The Status Consumption Trap

Status consumption happens when purchases signal wealth rather than utility. Millennials dominate this trend, especially on social media. Studies show 54% buy luxury goods to display status—40% higher than older generations. The cost? Average non-mortgage debt hits $27,251. Over a third would borrow to maintain appearances. Those most eager to show wealth are often the least financially secure. The irony runs deep.

What The Wealthy Actually Buy

Billionaires like Jeff Bezos drove a Honda Accord, Mark Zuckerberg owns a $30,000 Volkswagen, and IKEA founder Ingvar Kamprad flew economy. Their luxury is invisible. Brands like Bottega Veneta, The Row, and unlabeled Hermès signal comfort without shouting. Logo prominence inversely correlates with actual wealth. The wealthy know true status is needing zero symbols, a secret millennials are only starting to grasp.

The Instagram Effect On Spending

Social media fuels aspirational addiction. Eighty-five percent of Gen Z say it shapes their luxury purchases. Instagram turns every coffee shop, vacation, or handbag into audience validation. Luxury brands target aspirational middle-class consumers, not billionaires. A $5,000 Dubai vacation gets more engagement than a savings account. Millennials spend money they don’t have to impress people who don’t care. The cycle is hard to escape.

The Real Cost Of Performance

Consider the math: a $1,000 BMW lease × 12 months = $12,000, plus $2,400 for IV drips, a $4,000 handbag, $700 mixer. Over ten years, the car alone costs $120,000 in lost investment returns. Average millennials risk retiring 5–10 years later than those who skip performative purchases. The wealthy understand opportunity cost in ways aspirational spenders never will, quietly building freedom instead.

Seven Categories Define Wealth Illusion

Seven categories capture the millennial wealth fantasy: high visibility, premium pricing, strong branding, zero utility beyond status. The wealthy deliberately avoid all seven. They know that in rooms of billionaires, no one notices your bag, car, or juice. Everyone is just living quietly. Here’s where middle-class illusions crumble and true financial security starts, revealing a stark divide between perception and reality.

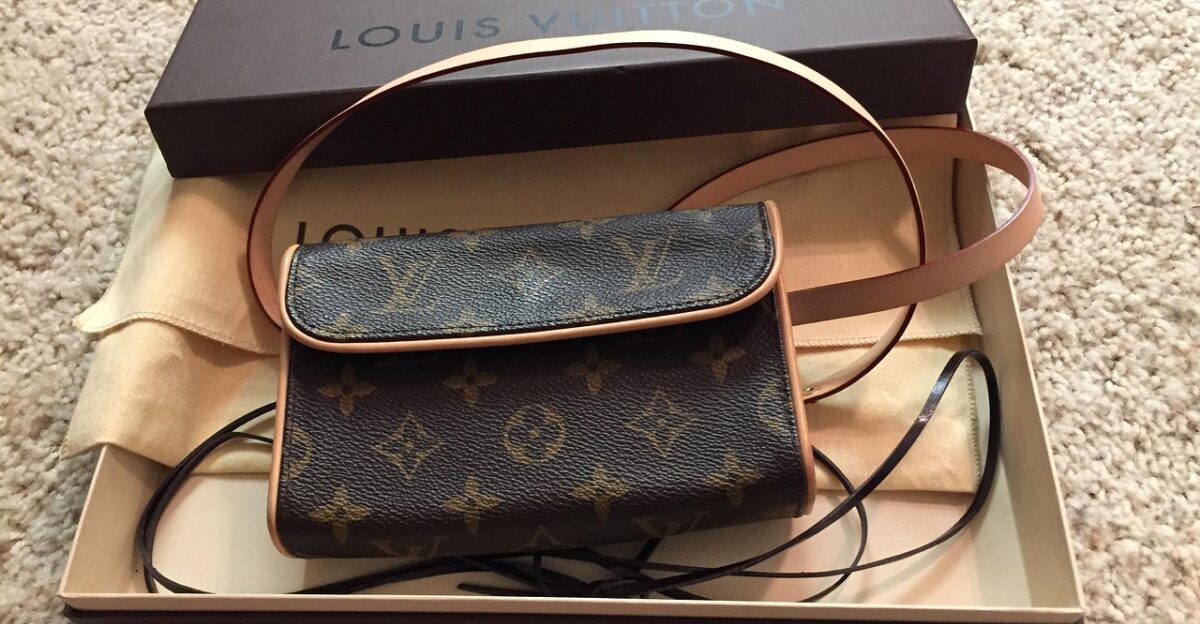

#1 – Logo-Heavy Designer Bags

A Louis Vuitton monogram bag costs $4,000; manufacturing costs $200–$250, a 16–20× markup. Millennials crave visibility. The wealthy carry Bottega Veneta, The Row, or unlabeled Hermès. They pay equally but quietly. The psychological cost adds up: anxiety over protection, pressure to justify usage, constant comparisons. True wealth favors invisibility. It’s not about logos—it’s about the freedom to own without proving anything.

#2 – Entry-Level Luxury Car Leases

BMW 3-Series or Mercedes C-Class leases cost $700–$1,000 monthly. Over three years, that totals $25,200–$36,000. Monthly payments alone cost millennials $120,000 over ten years. Insurance, maintenance, and depreciation add more. The wealthy buy reliable vehicles outright, often keeping them a decade. One decision costs years of retirement security.

#3 – Luxury Athleisure Wear

Lululemon leggings $98–$128, sports bras $58–$78, full outfits $500–$1,000. They promise fitness status but often appear in coffee shops, not gyms. Wealthy individuals wear functional Nike or Adidas gear, emphasizing utility over image. Old running shoes and basic shirts suffice. Lululemon thrives on aspiration, not performance. The lesson? Athleisure communicates identity, not health. True wealth doesn’t need validation through clothes.

#4 – Instagrammable Travel Experiences

Dubai, Maldives, Santorini—Instagram made them famous. Typical vacations cost $5,000–$10,000+, often financed. Millennials chase photo-perfect experiences, all for social approval. The wealthy return to quiet lake houses or take private trips unseen. They prioritize experience over documentation. The real cost isn’t financial alone—it’s psychological debt. Performing travel drains energy and funds. Those who stop performing begin to reclaim both time and money.

#5 – Premium Kitchen Gadgets

KitchenAid stand mixers cost $700, often unused. The wealthy hire chefs or rely on $50 tools accomplishing 99% of tasks. Premium gadgets serve identity, not function. Displayed items signal sophistication but rarely provide value. True wealth buys utility over image. Millennials equate spending with expertise. The gap between perceived skill and actual use highlights the illusion of wealth. Real financial security favors practicality.

#6 – Trendy Wellness Subscriptions

Green juices $12–$15, IV memberships $100–$500 monthly, cryotherapy passes. Wealthy people know sleep, walking, and whole foods outperform these costly trends. A $200 monthly drip yields zero advantage over basics. True health investment is invisible: nutrition, rest, movement. Status wellness purchases signal wealth without delivering it. Millennials pay for perception. The secret the wealthy leverage is that health doesn’t need a brand or a price tag.

#7 – Limited-Edition Sneakers And Streetwear

Travis Scott Jordan 1 sells for $170; resale $1,200–$1,800. Millennials camp out for drops, building sneaker portfolios. Scarcity drives artificial value. The wealthy wear comfortable, durable shoes. They understand hype creates perception, not actual worth. Paying $1,500 for a rare pair purchases status performance, not utility. Wealth is built on function, not scarcity illusions. The shoe doesn’t confer coolness; belief in it does.

Psychological Cost Of The Illusion

Status purchases trigger anxiety: protecting items, using them enough, comparing to others. The wealthy avoid this stress. They don’t track Instagram likes or question recognition. Mental peace is priceless. True luxury is internal, not external. Millennials spend on perception, trading freedom for approval. Learning to ignore performative cues is financially and psychologically liberating. Wealth isn’t what you show—it’s what you don’t need to prove.

Why Luxury Brands Target Millennials

Luxury brands don’t aim at billionaires. They target aspirational $75,000 earners wanting $200,000 lifestyles. Consumers stretch, finance, and incur debt to buy the illusion. Instagram marketing exploits ambition and insecurity, not actual wealth. Billionaires already own everything. Millennials fund the industry through desire for status. This gap is deliberate. Understanding it reveals why middle-class buyers subsidize the luxury market, while the wealthy quietly remain unaffected.

Compound Cost Of Status Spending

A $1,000 monthly luxury spend for ten years totals $120,000. Invested at 7% annual returns, it grows to $236,000. Over thirty years? More than $700,000. Every dollar on performance is a dollar lost to compounding freedom. A 30-year-old who skips status can retire at 55, one who doesn’t may retire at 65. This ten-year difference is the actual luxury. Numbers reveal what image alone hides.

What Actual Rich People Do

The wealthy invest in real estate, stocks, businesses, and education. They prioritize invisible luxuries: quiet homes, family time, functional cars, long-term investments. Experiences outweigh display. They avoid debt and performative spending. Real luxury is freedom from scrutiny and obligations. When wealth stops being a performance, it grows. Millennials who adopt these habits learn the paradox: the moment you stop showing off, financial security multiplies.

Shift From Aspiration To Quiet Luxury

In 2024, 50 million consumers left the luxury market. Global sales dropped 2% for the first time in 15 years. Aspirational buyers under $6,000 spent 35% less. Millennials are waking up to quiet luxury: understated, premium, invisible. Gen Z is learning value isn’t in others’ approval. The audience they performed for no longer matters. Cultural trends favor subtlety, restraint, and financial mindfulness over status signaling.

The Real Question

The most expensive purchase isn’t a bag or car—it’s freedom from performing wealth. Each status dollar is a dollar not compounding into security. Millennials can change this trajectory by learning what the wealthy already know. True luxury is comfort, invisibility, and independence from judgment. The lesson? Net worth and freedom outweigh Instagram aesthetics or fleeting social approval. The choice is deeper than spending.

The Wealth You Actually Want

The seven categories explored are expensive illusions, not inherently bad. The wealthy choose silence, reliability, and modesty over flashy consumption. They drive decade-old cars, carry unlabeled bags, and vacation privately. Real luxury is the ability to stop proving wealth. Every aspirational purchase avoided becomes freedom. True status is invisible, measurable in independence and security, not likes, labels, or Instagram posts. That is the ultimate wealth.

Sources:

Status Consumption and Economic Inequality: Research findings from HEC Paris and Princeton University, Journal of Consumer Research, 2024

Global Luxury Market Contraction And Aspirational Buyer Exit, Bain & Company Luxury Report, 2024

Warren Buffett’s 2014 Cadillac And Billionaire Frugality Patterns, Forbes and Business Insider, 2024

Lululemon Pricing And Premium Athleisure Market Analysis, Lululemon Official Data, 2025

Limited-Edition Sneaker Resale Market And Markup Analysis, StockX Market Report, 2024

Instagram Influence On Gen Z And Millennial Purchasing Decisions, McKinsey Consumer Insights Report, 2024