Four miles beneath the Permian Basin’s scorched Texas landscape, drilling technology has unlocked what was impossible just years ago: 1.6 billion barrels of oil trapped in rock formations twice as deep as anything currently producing.

The U.S. Geological Survey’s January 2026 assessment reveals 28.3 trillion cubic feet of natural gas alongside the oil—enough combined energy to power America for months. But reaching these riches requires drilling deeper than Mount Denali is tall.

What Lies Beneath

The Woodford and Barnett shale formations sit at depths of 18,000 to 20,000 feet, where temperatures exceed 300 degrees Fahrenheit and pressures crush conventional equipment.

These zones remained technically inaccessible until recent advances in horizontal drilling and hydraulic fracturing technology created pathways through rock that’s been sealed for millions of years. The discovery spans West Texas and southeastern New Mexico across America’s most prolific petroleum province.

A Resource Frozen in Time

Since the late 1990s, these deep formations produced merely 26 million barrels—enough oil for one day of U.S. consumption.

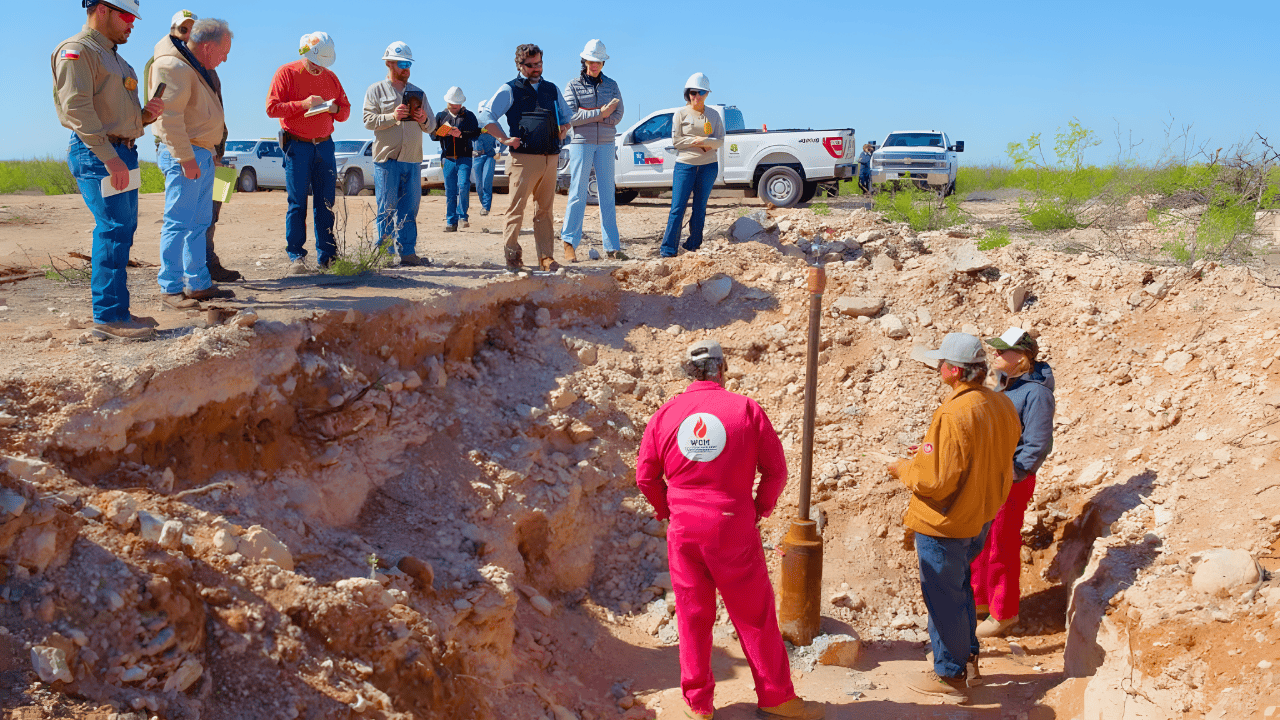

“These undiscovered resources were impossible to access before today’s advanced production technologies due to their depth,” the USGS stated in its official assessment. Modern rotary steerable systems and equipment operating at 20,000 pounds per square inch have finally cracked the code to ultra-deep extraction.

The Scale of Discovery

The 1.6 billion barrel find represents enough oil to fuel the United States for ten consecutive weeks at current consumption rates of 20 million barrels daily. The accompanying natural gas—28.3 trillion cubic feet—could supply American homes and businesses for ten months.

Yet this discovery appears modest compared to the Permian’s 2016 Wolfcamp assessment, which identified 20 billion barrels in shallower formations.

Industry Giants Circle the Prize

Diamondback Energy, ExxonMobil, Occidental Petroleum, and SM Energy are actively drilling test wells to map these deep zones. Diamondback characterized the intervals as potentially “Tier 1” resources—industry terminology for the most profitable drilling locations.

SM Energy has completed two exploratory wells across 20,000 net acres with promising initial results that are reshaping development strategies.

But Economics Tell a Different Story

West Texas Intermediate crude oil trades near $52 to $60 per barrel in January 2026—well below the $70 to $80 threshold required for profitable ultra-deep drilling.

Wells at 18,000 to 20,000 feet demand specialized equipment, extended drilling durations, and enhanced completion designs that double or triple costs compared to shallower targets. Current market conditions create significant headwinds for immediate development.

The Permian’s Continued Dominance

The Permian Basin produces 6.1 million barrels daily, representing nearly half of total U.S. crude output and positioning the region as the world’s second-largest oil field by production volume.

Only Saudi Arabia’s legendary Ghawar field—with 75 to 96 billion barrels remaining—exceeds the Permian’s output. The basin has produced over 30 billion barrels cumulatively since commercial drilling began.

Strategic Inventory, Not Immediate Production

Industry analysts view the Woodford and Barnett discovery as inventory extension rather than near-term production growth.

“These formations represent compelling alternatives to the Wolfcamp and Bone Spring as core play inventories shrink,” according to a TGS energy report analyzing the basin’s long-term potential. The discovery provides drilling targets for decades as shallower, more accessible formations gradually deplete.

The Water Management Advantage

These deep formations produce significantly less water than established Permian targets—a critical operational breakthrough.

The basin currently generates approximately four barrels of produced water for every barrel of oil, with certain areas yielding ratios exceeding ten to one. Lower water production reduces disposal costs, environmental liability, and infrastructure requirements that increasingly constrain shallow-formation development.

Expert Analysis: Technology Unlocks the Impossible

“The shale revolution has fundamentally transformed what we consider recoverable resources,” energy analysts note. Extended-reach horizontal wells now stretch up to four miles laterally through productive zones, while multi-stage hydraulic fracturing creates thousands of fracture networks that extract hydrocarbons from impermeable rock.

These capabilities have global applications, potentially unlocking similar ultra-deep resources in international basins.

Consolidation Creates Development Capacity

ExxonMobil’s $64.5 billion acquisition of Pioneer Natural Resources in 2024 created a dominant Permian position with 16 billion barrels of oil equivalent resources.

The merged entity commands production volumes approaching 2 million barrels of oil equivalent daily by 2027. Only supermajors possess the balance sheet capacity and technical expertise to develop marginal deep plays economically.

Environmental Pressures Mount

Texas regulators implemented stringent water disposal rules in June 2024 following induced seismicity concerns linked to deep injection wells.

Operators must now plug older wells within half-mile radii of injection sites and limit maximum injection pressures. The Permian Basin disposes of approximately 15 million barrels of produced water daily—630 million gallons—creating mounting environmental and regulatory challenges.

Methane Emissions Improve Dramatically

Methane emissions intensity in the Permian decreased by more than 50 percent from 2022 to 2024, according to S&P Global analysis. Absolute emissions fell 55.2 billion cubic feet year-over-year while production reached record levels.

Flaring intensity in 2023 registered 65 percent below 2015 peak levels despite persistent pipeline capacity constraints that occasionally force operators to burn excess gas.

Market Impact: Supply Glut Pressures Prices

The Energy Information Administration projects WTI crude averaging $52 per barrel in 2026 and $50 per barrel in 2027—levels that challenge drilling economics across most U.S. shale basins.

Global oil production exceeds demand by 0.5 to 2.5 million barrels daily throughout 2026, creating persistent oversupply conditions. OPEC+ spare capacity has diminished to 3 to 4 million barrels daily.

Economic Engine Powers Regional Growth

The Permian Basin generated $119 billion in U.S. economic output during 2024 while supporting 862,250 jobs nationwide. Texas received $3.4 billion in combined contributions to the Permanent University Fund and Permanent School Fund from oil and gas production.

New Mexico derives approximately 50 percent of state budget revenue from petroleum activities.

Production Outlook Faces Headwinds

U.S. crude oil production will decline from 13.61 million barrels daily in 2025 to 13.37 million barrels daily in 2026—the first annual decrease since 2021, according to EIA projections.

Permian rig counts dropped 19.7 percent year-over-year to 244 active rigs in January 2026. Drilling efficiency improvements have partially offset rig count declines.

Pipeline Capacity Races to Keep Pace

Natural gas pipeline takeaway capacity from the Permian Basin is expanding dramatically with projects adding 11.1 billion cubic feet daily by 2029. T

he Matterhorn Express (2.5 billion cubic feet daily) began operations in 2024, while the planned Eiger Express (3.7 billion cubic feet daily) targets mid-2028 startup. These pipelines connect Permian production to Gulf Coast LNG export terminals.

Energy Security Implications

The shale revolution transformed U.S. energy security, reducing net petroleum imports from over 12 million barrels daily in 2005 to approximately 1.2 million barrels daily by 2022. The United States now produces nearly 24 million barrels daily of crude oil and liquids—22 percent of global supply.

Enhanced domestic production insulates the economy from Middle Eastern geopolitical disruptions.

Technical Versus Economic Reality

The USGS assessment quantifies technically recoverable resources—volumes producible with current technology regardless of economic conditions.

This differs fundamentally from proven reserves, which require 90 percent certainty of economic recovery under current prices. Substantial portions of the 1.6 billion barrels may prove uneconomic at oil prices below $60 per barrel.

What Happens Next

Development of the Woodford and Barnett formations will likely remain delayed until cost structures improve through technological innovation or prices recover sustainably above $70 per barrel. Operators are pursuing measured delineation programs to establish geological understanding and refine completion techniques.

The discovery extends the Permian Basin’s productive life incrementally, ensuring America’s energy abundance continues for decades as the industry evolves from shallow to ultra-deep frontier development.

Sources:

“Assessment of undiscovered continuous and conventional oil and gas resources, Woodford and Barnett Shales, Permian Basin Province, Texas and New Mexico.” U.S. Geological Survey, January 2026.

“USGS: Permian Secondary Shales Hold 1.6 Billion Barrels of Recoverable Oil.” Journal of Petroleum Technology, January 2026.

“USGS releases assessment of undiscovered oil and gas resources in Woodford and Barnett formations.” U.S. Geological Survey National News Release, January 2026.

“Short-Term Energy Outlook.” Energy Information Administration, January 2026.

“Oil prices forecast to ease in 2026 under pressure from ample supply.” Reuters, January 2026.

“Permian Basin Contributes Over $119 Billion And More Than 862,000 Jobs Nationally.” Permian Basin Petroleum Association, August 2025.